How AI can help Banking and Financial startups

Statistics by Accenture shows that AI will add $1.2 trillion in value to the financial industry by 2035. However, these predictions are beneath contempt if banking and financial businesses aren’t aware of the potential benefits presented by AI. Some of the top leaders are already reaping the benefits of AI in the banking and finance industry, yet there are still many who overlook this disruptive technology.

Table of Content:

It is widely believed that the financial industry was one of the first to implement AI strategies and have been operating on the frontlines of AI ever since. Even bank customers have been engaging with digital assistants like chatbots and other AI-enabled technologies. In fact, almost 80% of banking institutions today have developed robust AI strategies and many of them even have their own AI departments.

The Growth of AI and Fintech

Fintech startups flourished when technology became the central focus in the financial industry. The initial wave of fintech startups was closely associated with the public distrust in the traditional banking system followed by the global spread of smartphones.

Smartphones became the primary means by which people access the internet and use different financial services. This new wave of mobile technology gave smartphone users fully operational financial services at hand. It also helped newly-established financial startups with a number of technologies including:

- gathering relevant data like the user’s location;

- digital signature;

- digital assistants (such as chatbots) for customer support;

- providing custom advice, offers, and service based on this user-insight;

- automated transactions and bills, and much more!

Another quantum leap in the banking and financial industry was followed by the rise of cloud-based software. Cloud computing became a powerful tool in providing an unrivaled level of agility, security, and scalability to banks. For use cases such as data analytics, batch processing, and data storage, banks can access the cloud as and when required, which means they can utilize such resources more flexibly and efficiently.

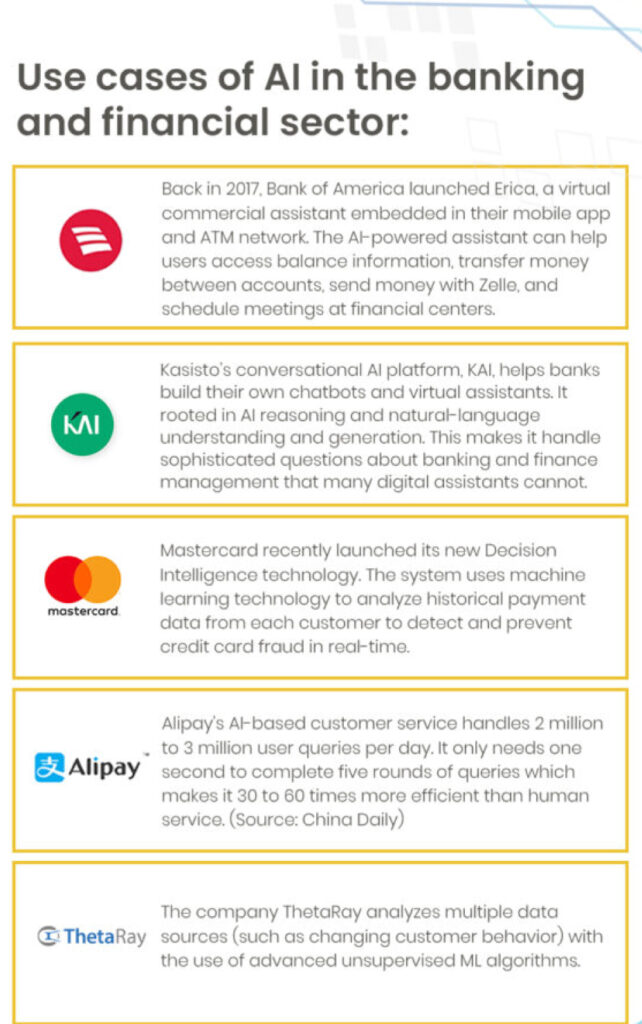

The integration of AI in banking and finance has given a new wave of applications and services in the financial industry. Banks are now actively evaluating opportunities to use AI for automating claims handling, detecting fraud, and providing personalized recommendations to clients.

AI also helps in improving the quality of customer service. The use of conversational AI in banking has been big. For instance, intelligent solutions such as chatbots, virtual clones, and digital voice assistants continuously engage with clients in real-time through multiple channels.

Below are some of the use cases of AI in the banking and finance sector:

Fintech for startups

The finance industry has arguably experienced more innovation than any other sector and history is the witness. This is the reason why this is one of the most targeted industries for startups. Some want to enter this industry to challenge the traditional banking system while others want to improve the current banking scenario with their innovative products. Most FinTech startups make use of Artificial Intelligence to improve their solution and decisions made with them. Here are the various ways AI benefits startups:

- With a huge array of historical data, you can compare customer’s consumer behavior. Find the smallest details and prevent fraud in advance. AI tools are constantly being trained and updated as they accumulate data with which they work.

- Consulting services – for example, chatbots – can recommend suitable financial products and objects for investment for clients, further reducing risks.

- Blockchain is an excellent solution in terms of providing financial data transparency and traceability.

- Technology also prevents the user’s private information. When needed, it provides relevant information anonymously, without extracting all the information in the banking system. This way, it becomes easier to extract data while also not disturbing the banking system as a whole.

Are you ready to transform your startup? Take the plunge by joining hands with us. Click here to connect.